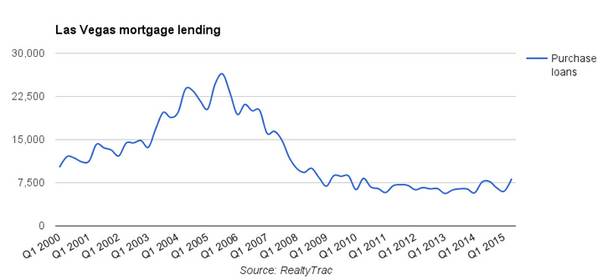

Lenders have been issuing Las Vegas homebuyers more mortgages this past year, but volume still pales in comparison to the peak of the real estate bubble, a new report says.

A total of 8,191 mortgages were doled out for home purchases in Southern Nevada in the three months ending June 30, up 8 percent from the same period last year, according to RealtyTrac.

The pace was just behind the national average. Lenders issued roughly 738,000 loans for purchases nationally in the second quarter, up 9 percent year-over-year.

Meanwhile, lenders have been refinancing mortgages locally and across the country at a rapid pace this past year amid historically low interest rates that, despite rising since January, remain below last year’s levels.

A total of 10,273 refinancing loans were issued in the second quarter in the Las Vegas area, up 40 percent from the same period last year, RealtyTrac reported.

Nationally, lenders wrote more than 1.2 million “refis” last quarter, up 32 percent.

The average interest rate in June for a 30-year mortgage was 3.98 percent, up from 3.67 percent in January but down from 4.16 percent in June 2014, according to mortgage-finance company Freddie Mac.

Rates climbed again last month, to an average of 4.05 percent.

Despite the upswing in Las Vegas for purchases, mortgage lenders were far busier here last decade before the economy collapsed, when banks gave money to practically anyone to buy a place. Fueled by easy money, housing prices skyrocketed.

During the bubble years of 2004 to 2006, lenders issued an average of 7,331 loans each month for home purchases in Southern Nevada, according to RealtyTrac data.