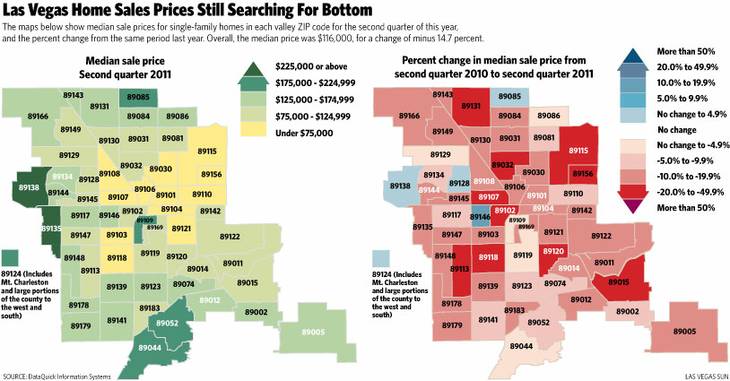

Homes in 53 of 58 Las Vegas ZIP codes saw their prices fall over the past year, according to a San Diego research firm.

DataQuick reported that Clark County’s home prices as a whole fell 14.7 percent to $116,000 from the second quarter of 2010 to the second quarter of 2011.

That equates to a price per square foot of $66, according to DataQuick, which tracks sales of new and existing homes and condos.

The steep decline is a reflection of the decline in home prices since a federal homebuyer tax credit effectively ended in April 2010.

Many analysts said Las Vegas has yet to hit the bottom in this yearlong wave of price declines. Prices had been stable in 2009 and early 2010.

The five valley ZIP codes where prices increased were 89124 in Desert Shores east of Summerlin (up 0.3 percent); 89128 south of Southern Highlands (up 3.7 percent); 89138 in Summerlin (up 2 percent); 89146 near Spring Valley (up 13 percent) and 89085 in North Las Vegas (up 2.3 percent).

In 10 ZIP codes, including 89015 in Henderson, 89032 in North Las Vegas and eight in Las Vegas and unincorporated Clark County, prices declined 20 percent or more.

The highest median price per square foot of all properties was in 89109 on the Strip at $196. The median price of all units sold was $180,000, which was a 1.9 percent decline from the second quarter of 2010. The 155 sales in 89109 were 12.4 percent fewer than in the second quarter of 2010.

The lowest price per square foot was 89030 in North Las Vegas at $33. The median price of homes sold in that ZIP code was $40,000, which is an 11.3 percent decline from the second quarter of 2010. The 139 sales in 89030 were 13.7 percent fewer than the second quarter of 2010.