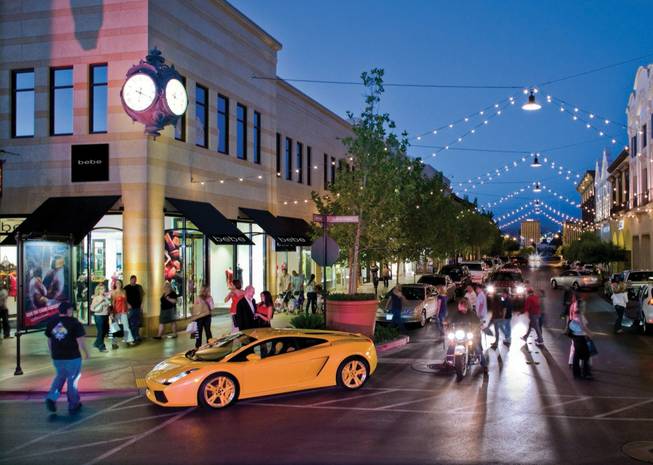

Town Square

Published Thursday, Jan. 13, 2011 | 9:34 a.m.

Updated Thursday, Jan. 13, 2011 | 4:10 p.m.

Map of Town Square

Lenders owed $449 million have asked a New York bankruptcy court to allow them to foreclose on and resell the big Town Square mall and office complex in Las Vegas.

Talks for a voluntary foreclosure have broken down, attorneys said in a motion filed this week in the massive bankruptcy case of Lehman Brothers Holdings Inc.

The lenders seeking to foreclose on the Las Vegas mall are led by their administrative agent, the Bank of Nova Scotia, New York Agency.

Bank of Nova Scotia claims Lehman Brothers is not a party to the first-priority mortgage encumbering Town Square and that Lehman "has no property interest in the Town Square Mall."

Nevertheless, a title insurance company handling the foreclosure has told Bank of Nova Scotia that any title issued after the foreclosure will exclude a $72 million claim Lehman has asserted against Town Square's developers, brother and sister Jeff and Jacquelyn Soffer.

The Soffers' Florida-based Turnberry development company is known in Las Vegas for developing not just Town Square, but high-rise condominiums and the bankrupt and stalled Fontainebleau casino resort.

In 2009, the Soffers sued Lehman Brothers, the collapse of which in part triggered the nation's financial near-meltdown in 2008.

The Soffers and three of their companies charged Lehman had reneged on part of a commitment to provide $1.5 billion in financing for three projects developed by the Soffers' Aventura, Fla.-based Turnberry Associates development company, where the siblings are executives.

The projects were the Fontainebleau Las Vegas retail project, the 93-acre Town Square shopping center in Las Vegas and the Aventura Mall in Florida.

While the Fontainebleau and Aventura financings closed, Lehman Brothers failed to provide promised long-term financing for Town Square in Las Vegas, the lawsuit charged.

The Turnberry companies said the initial $520 million in Town Square construction financing was provided principally by Deutsche Bank.

Development of Town Square started in 2004 and Turnberry later sought customary long-term take-out financing as well as an additional $100 million for the project, the lawsuit said.

The Soffers asserted in their suit that at the insistence of Lehman, they personally were the borrowers in July 2007 under a $95 million "interim advance" credit facility for Town Square, with the expectation that Lehman would later include the interim advance in permanent financing.

"Lehman has now made clear that it is refusing to honor its commitment to provide the permanent financing," charged the lawsuit, filed several months after Lehman filed for bankruptcy on Sept. 15, 2008.

But Lehman Brothers, in responding to the lawsuit, denied it made representations it would provide long-term financing for Town Square and filed a counterclaim accusing the Soffers of breach of contract for failing to pay $72 million due under the $95 million loan.

Later, Lehman Brothers sued Jeff Soffer, seeking to recover hundreds of millions of dollars loaned for the Fontainebleau project.

In August, Town Square acknowledged lenders had initiated foreclosure proceedings against it and said the foreclosure would have no effect on operations at the center with 900,000 square feet of retail, restaurant and entertainment space and another 300,000 square feet of office space.

In a statement Thursday, Turnberry said talks about a voluntary foreclosure are ongoing and that it hopes to maintain an ownership stake in the property at Las Vegas Boulevard and Interstate 215.

“This filing is not a surprise, nor is it new,’’ said Mike Wethington, general manager of Town Square Las Vegas. “Our lenders filed their initial foreclosure action last summer, and we have continued to discuss a resolution with them. Those talks are ongoing. The Bank of Nova Scotia filed this action in the Lehman Brothers bankruptcy case simply to protect its interest in the mall.

"The financial negotiations taking place have no effect on the daily operations of Town Square and do not reflect the shopping center’s performance. We’ve opened approximately 16 tenants in 2010, and several additional ones are on tap for 2011. Our retailers, restaurants, vendors, employees and customers will notice no changes as a result of this action.

"Turnberry continues to manage the property, and we are optimistic that we will emerge from these negotiations with those management rights and an equity interest in the mall,” Wethington said.

The $72 million allegedly owed by the Soffers to Lehman Brothers for the Town Square loan remains a hurdle for Bank of Nova Scotia as it tries to foreclose on Town Square.

Bank of Nova Scotia insists the Lehman Brothers bankruptcy estate has no enforceable interest in Town Square -- in part because an appraisal found the value of the property in May was $415 million and has likely fallen further since then, less than the $449 million owed under the first-priority mortgage.

Attorneys for Lehman Brothers have not yet responded to those assertions.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy