For many in the business community, 2013 was a year of hope.

The real estate market boomed, companies relocated to Southern Nevada, and the economy appeared to pick up.

But the year also posed challenges for some. Developers with big plans saw their dreams dashed. Casinos and airlines contended with staffing issues.

Who had a good year and a not-so-good year? Read on:

-

Good year: The local economy

A year ago, there was much uncertainty about Southern Nevada’s economy. Now, as 2013 comes to a close, there’s far more optimism as several of the region’s economic indicators appear to be trending upward.

The valley’s unemployment rate was 9.4 percent as of October. That still places Las Vegas third-worst for unemployment among similar-sized cities but was a marked improvement from a year earlier, when the unemployment rate was 10.3 percent. Nevada’s unemployment rate improved 15th-fastest in the country this year.

The average daily room rate has risen every month except October, and the city’s occupancy rate was in the high 80s for most of the year. Convention attendance grew 4 percent to 4.5 million, the number of conventions and trade shows was up 3.1 percent to 19,149, and local resorts forecast favorable visitation numbers for next year.

Gaming revenue grew 1.2 percent in Clark County and 2.5 percent on the Strip, and while gambling revenue downtown was down 2.9 percent, the Downtown Grand recently opened, which could attract new players.

Still, the picture isn’t entirely rosy. Somewhat worrisome for the long term is two consecutive months of decline in consumer confidence. The Conference Board’s Consumer Confidence Survey decreased sharply in October, then dipped again in November. Local tourism leaders say consumer confidence numbers are typically indicative of how willing people are to travel and spend money.

-

Good year: North end of the Strip

Since the closing of the Stardust and Sahara, the north end of the Strip has been a sore spot for the city.

But two major resort projects promise to breathe life back into the corridor.

The SLS, the $415 million, 1,600-room resort on the grounds of the former Sahara, is considered a key factor in the recovery of the Strip’s struggling north end. It is being developed by SBE Entertainment CEO Sam Nazarian, with a scheduled opening next year.

Across the street, at the site of the former Stardust and failed Echelon, Asian gaming giant the Genting Group plans to roll out a 3,500-room, Chinese-themed resort with a 175,000-square-foot casino. Resorts World Las Vegas is slated to open in 2016 and could be the Strip’s biggest energizer in years.

Boyd Gaming sold Genting the 87-acre site for $350 million, giving up its foothold on the Strip.

-

Good year: Wet ’n’ Wild

In the war of water parks, Wet ’n’ Wild emerged the winner.

The 41-acre water park in southwest Las Vegas was mobbed with fans when it opened Memorial Day weekend and maintained its popularity throughout the season. Owners hired more than 400 people to serve the crowds.

The $50 million park, developed by Village Roadshow Ltd., features 25 slides, a wave pool and a lazy river.

Its competitors across town didn’t fare as well.

Construction crews building the $23 million Cowabunga Bay in Henderson hit a vein of caliche 15 feet underground, delaying the park’s opening by a year. Developers also had trouble importing a custom slide from overseas.

In August, they sold the property at a 50 percent discount to a developer from Utah. General Manager Shane Huish said it still will open in April.

Plans for Cowabunga Bay call for a wave pool, a lazy river and several clusters of slides with a ’60s beach theme.

-

Good year: Sheldon Adelson

2013 was a great year for casino magnate Sheldon Adelson.

His Las Vegas Sands shattered revenue records, making $3.57 billion during the third quarter, an increase of more than 30 percent from the previous year. Adelson raked in truckloads of dough from his Macau properties – more than $784 million, an almost 61 percent year-over-year increase.

By comparison, his Las Vegas properties saw a revenue increase of 2.9 percent to $375 million.

Strapped with even more cash and confidence, Adelson returned to the political sphere, starting a controversial campaign against Internet gambling. He pledged to invest as many resources as possible to stop the spread of online gaming, which he called a “societal train wreck.”

Public campaigns are nothing new for Adelson. The political super-donor pumped more than $100 million into the Republican Party’s 2012 election efforts.

-

Good year: Parks and plazas

The Strip’s two biggest casino companies are capitalizing on a new trend for Las Vegas Boulevard: pushing customers off the casino floor and into the great outdoors.

MGM Resorts International is investing $100 million to transform land between New York-New York and the Monte Carlo into an outdoor plaza and mall with a park, shops and restaurants.

Caesars Entertainment is busy building its $550 million Linq development between the Quad and the Flamingo. Anchored by the High Roller, the world’s tallest observation wheel, the Linq also will feature shops, restaurants and entertainment.

Both projects point to a growing trend of offering customers options outside the casinos.

“Today’s customer wants to be out in the open and wants to be independent,” MGM Resorts CEO Jim Murren said in June. “They don’t want to be told what to do. They don’t want to be captured and trapped in any kind of resort.”

There’s science to back up the companies’ decisions. UNLV mathematician Tony Lucas found in 2003 that slot players felt more satisfied in areas that were easier to navigate.

-

Bad year: The Riviera

Poor Riviera. In under a year, the historic resort lost almost its entire management staff, ending a bitter chapter in the property’s history.

In late June, CEO Andy Choy was fired. Senior Vice President of Gaming Noah Acres resigned the same day.

Their exits followed several other top-level resignations, including those of CFO Larry King, Senior Vice President of Operations Bobby Ray Harris and Director of Security and Surveillance Doug Poppa.

Staffers from Paragon Gaming, a local gaming development company headed by Diana Bennett, replaced Choy and Acres.

Since the Riviera opened in 1955, owners have filed for bankruptcy three times: in 1985, 1991 and 2010. The company emerged from the latest round in November 2010.

-

Bad year: Lake Las Vegas

Just when it seemed like Lake Las Vegas was mounting a comeback, the lavish, financially plagued project was dealt another blow. Casino MonteLago, the community’s only casino, in late October was shut down for the second time in 3 1/2 years.

Owner Jon Berkley, CEO of Intrepid Gaming, said he closed shop due to “lease issues” with landlord Kam Sang Co.

The small casino opened in May 2003, closed in March 2010 during the recession and reopened in May 2011 to throngs of gamblers. It originally was owned by Cook Inlet Region Inc., a company owned by members of an Alaskan American Indian tribe.

The 3,600-acre Lake Las Vegas community, off Lake Mead Parkway in Henderson, was designed as an elegant Mediterranean village surrounding a 320-acre man-made lake. It became one of the biggest real estate flops in the valley, enduring foreclosure, bankruptcy and big drops in tourism.

The project, however, had been showing signs of improvement this year. Home prices were on the upswing, hotel occupancy was inching higher, and new tenants joined the retail district.

Wall Street billionaire John Paulson’s investment firm also bought at least 900 acres of land there, with plans to sell it to homebuilders.

-

Bad year: Stadium developers

It also was a rough year for aspiring sports arena developers. One was sued for fraud and barred from doing business in Henderson, while another threw in the towel after losing a partnership with UNLV.

Texas developer Chris Milam didn’t have any teams lined up to play in the valley but sought to build an indoor arena and three stadiums south of the M Resort in Henderson. His Las Vegas National Sports Complex was expected to cost more than $1 billion to build.

Speculative, multivenue developments are practically unheard of, as they’re almost impossible to finance, but the Henderson City Council unanimously approved a preliminary project agreement with Milam’s group and fully supported selling the 485-acre, federally owned project site.

In the end, Milam never took ownership of the land and didn’t build a thing. No teams committed to moving to the planned complex, the financing fell through, and Henderson sued Milam’s group for allegedly trying to flip the project site to other developers. As part of a March court settlement, Milam was banned from doing business in Henderson.

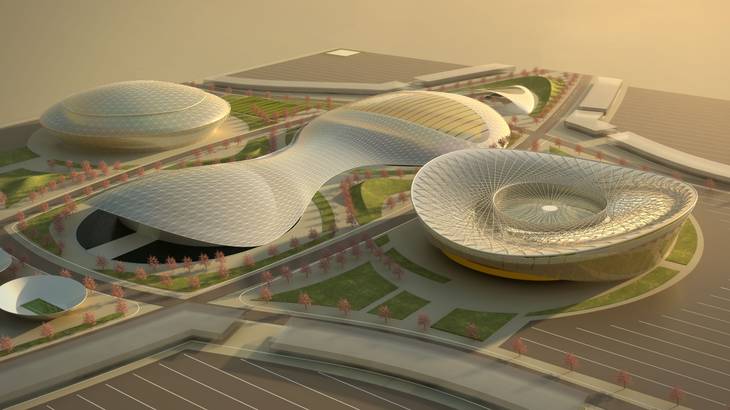

Meanwhile, Southern California developer Majestic Realty Co. proposed building a 60,000-seat domed facility for UNLV for $800 million to $900 million.

Majestic President and Chairman Ed Roski pledged almost $400 million to the on-campus project but couldn’t secure the rest of the funding. A bill to create a special tax district to finance the stadium’s construction failed, and Strip resort owners criticized the project’s cost.

In March, UNLV announced it was severing ties with Majestic and would proceed with plans to develop an on-campus mega-events center without the company.

-

Bad year: State slogan

There were great expectations for the Nevada Tourism Commission’s new state slogan, but it largely fell flat when it was announced.

Maybe it was because it was created by a New York advertising firm. Or because it took $9 million and two years to develop. Or because the bar had been raised so high by slogans such as “I love New York,” “Virginia is for lovers” and “What happens here, stays here.”

Whatever the reason, “Nevada: A World Within. A State Apart” flopped.

Southern Nevadans scoffed that it ignored Las Vegas. State officials argued that the Las Vegas Convention and Visitors Authority already has a big budget dedicated to Southern Nevada and the state campaign was meant to focus on rural Nevada. They urged people to give it time, to let it grow on them.

That hasn’t happened.

-

Bad year: ManhattanWest’s developer

Alex Edelstein had big plans for Las Vegas.

During the boom, he built the $230 million Manhattan Condominiums south of the Strip and sold its initial 700 units. He then launched ManhattanWest, a stylish, $330 million project with office, retail and residential space on Russell Road at the 215 Beltway.

That one, however, didn’t go so well.

The first phase of the 20-acre project was supposed to wrap up by spring 2009, but Edelstein mothballed ManhattanWest during the recession after his lenders reportedly yanked his financing. In June, he sold the partially completed project for $20 million, a sliver of what he spent on it, to the Krausz Cos., of California.

Krausz now is developing the project as the Gramercy with WGH Partners.

Edelstein blamed the media for his failures, saying the press put “perennially negative spin on the economy and the housing market.”

“If you read and believe all of the negative stories in the traditional media and vulture blogs, it’s easy to get a skewed perspective on what’s really happening in the economy and the housing markets today — particularly in the local Las Vegas market,” Edelstein said in 2008. “We’ll go hand-to-hand with anyone who knocks Las Vegas’ prospects without an understanding of our market and the real facts. We kept waiting for the media to pick up the positive news here and finally decided we needed to just get the word out ourselves.”

Edelstein was CEO of Gemstone Development, which now appears to be defunct. He currently is chairman of the board of Servio, an online marketing firm in San Francisco.

-

Bad year: Allegiant flight attendants

In 2010, Allegiant Air flight attendants scored what they considered to be a big victory when they successfully campaigned and voted to be represented by the Transport Workers Union.

But three years later, the flight attendants continue to negotiate their first contract with the Las Vegas airline.

Union leaders say first contracts often are the most difficult because every term must be negotiated from ground zero. That seems to be true for Allegiant, whose top executive, Maurice Gallagher, has made no secret of his disdain for negotiating with third parties.

For now, the flight attendants appear to be on the losing side of the impasse. But they still have some tricks up their sleeves.

They have undertaken a strategy of publicly embarrassing the airline to goad management into serious contract talks.

The union launched willallegiantbethere.org, a website that highlights the airline’s flaws. It includes a map of cities and routes the airline has abandoned for financial reasons, a running list of delayed flights and a warning to customers about Allegiant’s fees.

“It’s business, and part of the tactics of these third parties is to do things that try to get a rise out of us and to somewhat embarrass us ... or get our attention,” Gallagher said earlier this year. “We’re mindful of those things. You just kind of roll your shoulders a little and say, ‘Really?’ We’ve been doing this for 2 1/2 years with them, and we’re at a bit of an impasse over some technical issues, but we’ll get through it. We have a great future, and our flight attendants are part of that future.”