Daniel Wiafe, a self-proclaimed “House Flipping Ninja,” boasts online that he can teach people to “flip houses for ca$h money!”

The Las Vegas investor and reality TV star goes after homes whose owners are itching to sell. They’re people who want “fast cash ... even if they take a big loss,” Wiafe said, like a down-on-its-luck family that pawns its jewelry.

House flippers can make money in the valley, he said, but overall, it’s probably not the best market these days.

“There’s way too many people that are trying to get into the real estate game down here,” he said.

House flipping was a hallmark of the real estate bubble, when investors, often with little or no experience but backed by easy money, bought homes and sold them for profit a short time later. The get-rich-quick tactic helped inflate prices to absurd levels until the bubble burst and the economy crashed.

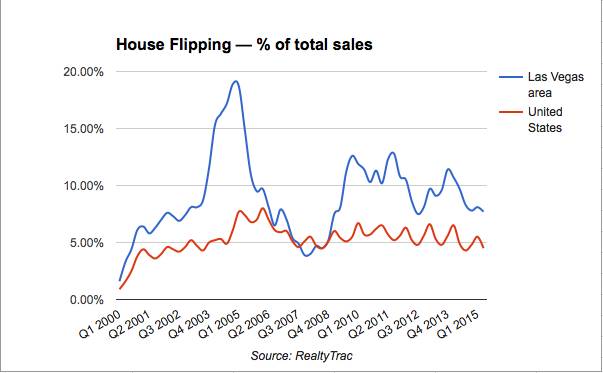

Southern Nevada remains one of the most popular places in America to flip houses, thanks to flipping-focused reality TV shows and Las Vegas’ lower home prices, transient population and long-standing image as an easy place to make a quick buck, industry pros say.

But overall, flipping isn’t nearly as common here as it used to be, and investors can make a lot more money elsewhere.

Flipping comprised 7.7 percent of single-family home sales in the Las Vegas area in the quarter ending June 30, down from 9.7 percent the same time last year, according to RealtyTrac, which defines flipping as selling a house within a year of buying it.

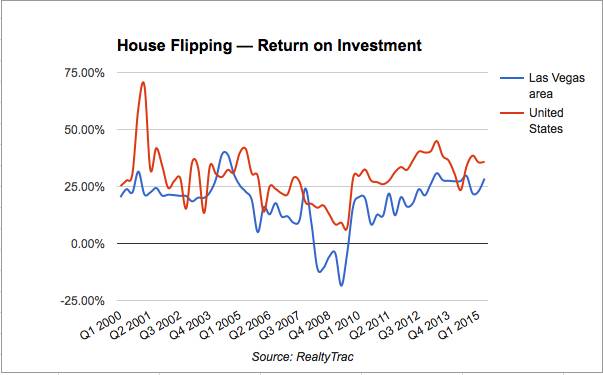

Investors booked an average return of 28.5 percent — or about $48,200 — on each deal last quarter, up slightly from 27.4 percent a year earlier.

Despite the drop in volume, Las Vegas tied for 11th in the country for its share of flips. Fernley, a small city near Tesla Motors’ new battery plant in Northern Nevada, was No. 1, with flips comprising 11.4 percent of all sales, RealtyTrac reported.

Nationally, 4.5 percent of single-family home sales last quarter were flips, down from 4.9 percent a year earlier, and investors made an average return of 36 percent — or about $70,700 — last quarter, up from 23.4 percent a year ago, according to RealtyTrac.

Those profits are the sales price minus the purchase price and do not account for renovations or other costs the flippers incur.

Las Vegas broker and investor Glenn Plantone was flipping five to seven homes per month here a few years ago, when prices were growing faster than they are now. Today, he’s not finding as many lucrative deals in the valley but has about 15 deals in the pipeline in Charlotte, N.C., where he flips homes with his brother.

“Now that Vegas is kind of drying up, I’m looking at other markets,” said Plantone, owner of VIP Realty Group.

Realty One Group broker Mark Sivek has a client who a few years ago bought about 100 homes to flip. Today, profits are getting squeezed on new deals, so “we really haven’t done much,” Sivek said.

“Is there still an opportunity (to flip homes)? Yes, but certainly not like what it” used to be, said Heidi Kasama, managing broker of Berkshire Hathaway HomeServices’ Summerlin office.

Nationally, slowing price growth and a possible interest-rate hike — which would raise borrowing costs, potentially shrinking the pool of buyers — could pinch flippers’ profits in the coming year, RealtyTrac Vice President Daren Blomquist said.

He also noted that lenders aren’t repossessing nearly as many homes as they used to. Discounted, bank-owned houses had been a “major source of supply” for flippers in recent years, he said.

Southern California investors told Blomquist they’ve stopped flipping because of narrower profits, but he suspects they won’t be gone forever.

“They’ll probably come back to it at some point,” he said.

Last decade, few places got as crazed with flipping as Las Vegas, the epicenter of America’s real estate bubble. In late 2004, a peak of 18.9 percent of single-family home sales in the valley were flips, compared with a national peak of 8 percent in early 2006, according to RealtyTrac.

Lenders gave mortgages to practically anyone, often for little or no money down, and it seemed everyone was an investor, even if they didn’t know anything about real estate.

Tim Kelly Kiernan, now a real estate agent, had a craps dealer friend who loaded up on homes.

“This guy can barely walk and chew gum at the same time, and he’s got nine houses,” said Kiernan, of RE/MAX Benchmark Realty. “It’s crazy.”

After the market crashed, investors streamed in to gobble up cheap homes, pushing up prices here at some of the fastest rates nationally. They typically rented out the properties, but a good number of buyers came for quick profits, including Wiafe, the House Flipping Ninja.

A former Internet marketer, Wiafe got into real estate in Tulsa, Okla., in 2010. His online tutorials caught the attention of HGTV producers, who signed him and his wife, Melinda, to star in their own show, called “Flipping the Heartland.”

“Daniel Wiafe is a real estate maverick who takes risks because he believes he’ll come out on top no matter what,” the show’s website says. “Melinda, his savvy wife and business partner, crunches numbers and does her best to keep Daniel from running the family into the red.”

The first season, with 13 episodes, aired this year.

Wiafe, who still spends a few months a year in Tulsa, moved to the valley in 2012. He works from a second-floor office suite on Rainbow Boulevard at Washington Avenue, although the sign on his front door is for Nevada Divorce Center, his document preparation and filing venture (“Home of the $199 Nevada Divorce!”).

Working from lists he buys, Wiafe says he targets houses held by “absentee” owners, including people who inherited a home but don’t have the money to fix it up; those who bought a place years ago as a vacation home, but the house is "just sitting there, rotting"; or out-of-town landlords whose tenants trashed the place.

The first house he flipped locally was owned by a woman in Ohio who bought it in 2001 for $250,000. Her renters, however, had turned it into a marijuana grow-house and, according to Wiafe, had racked up $70,000 in unpaid power bills.

Police raided the house. Wiafe bought it for $110,000, put $1,000 worth of touch-ups into it and sold it for $140,000 to an investor. That buyer made $25,000 worth of repairs and sold the house for about $220,000.

“He made a killing,” Wiafe said.

Faced with higher prices they helped create, investors have been backing out of Las Vegas. Price growth has slowed substantially from a few years ago, but homes still are cheaper than in other major markets, and plenty of wannabe flippers want in.

Thanks in no small part to reality TV shows such as “Flipping Vegas” and “Flip this House,” flipping seems like an easy payday to many would-be investors, real estate agents say — that is, until they find out what’s needed to rehab a beat-up house and make a profit selling it.

“Lots of people are armchair quarterbacks, but once they see what it takes, they back off,” broker Sivek said.

Kasama, of Berkshire, met with a Las Vegas man in his mid-20s who wanted to buy a house, hire low-priced contractors and sell the place for a 10 percent return. He had never flipped a house, but as Kasama put it, “people have these visions in their head.”

“It isn’t out there,” she said of his dreamed-up profit. “And he’s still thinking about it.”